A Bank Looks to Move the Needle on Affordable Housing

/When it comes to bank philanthropy, the biggest story over the past several years is the massive outpouring of investment for urban youth and employment. But financial giants are also steady funders in an area even closer to home: community development and housing. With a recent grant of $3.75 million to Enterprise Community Partners, the Bank of America Charitable Foundation continues a longstanding history of support for affordable housing initiatives.

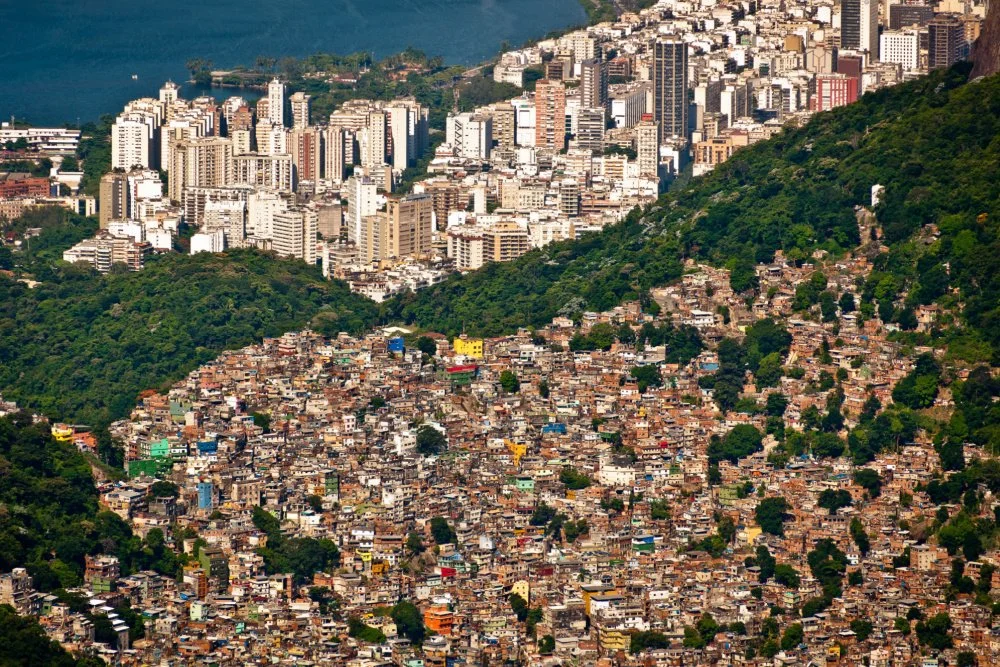

Community development funding from a bank isn’t the flashiest of grants. But this funding can have major repercussions, including whether or not a low-income family finds housing, or how prosperous a neighborhood will be a decade from now.

To be sure, the big banks bear enormous blame for stripping wealth from low-income communities through predatory mortgage lending in recent years, and given that disgraceful history, it's hard not to be ambivalent about their current efforts to help these same communities. As a matter of practice, though, nonprofits working to alleviate a pernicious housing crisis need all the help they can get.

We’ve often observed that philanthropy can’t tackle the urban housing crunch alone. However, more parties are looking at new ways to finance affordable housing, often in partnership with private interests (i.e. through impact investing) and with state and local governments. Enterprise Community Partners, along with its CDFI and investment arms, has been a major player in that space for a while.

This new three-year grant from BofA supports projects in cities across the nation. Enterprise cites work in Detroit to push for inclusionary zoning, and in San Francisco on the Rental Assistance Demonstration, a HUD program to finance long-term affordability for public housing projects. What many of these projects have in common is their attention to public or public-private solutions.

Even as the Trump administration’s budget cuts loom at HUD, affordable housing advocates are pushing local and state governments to change public policy to support more affordable housing. For philanthropy, funding research and advocacy can be key, and Bank of America’s grant to Enterprise will also support “advocacy for improved policies at the federal, state and local level,” where vigorous and sustained effort will be required to tackle housing insecurity.

Bank of America isn't the only financial behemoth Enterprise collaborates with. It has received funds from JPMorgan Chase, Santander, Citi, Capital One and MetLife. Its roster of foundation supporters is equally impressive, including national funders like Gates, Rockefeller and Kresge, and regional powerhouses like MacArthur and Annenberg. On top of its community development projects, Enterprise is a grantmaker in its own right, with a focus on disaster relief.

Enterprise Community Partners' efforts to advance "new financial tools” to fund affordable housing are part of a larger spurt of innovation now going on in this sector. One example is Housing Trust Silicon Valley’s TECH Fund, a means to raise early flexible capital for developers in the housing-starved Bay Area. (More on that in a future in post.)

It's hard to forget the bad business practices that went down in the go-go years of the real estate boom over a decade ago. But the reality is that if cities want to build more affordable housing—and change policies to enable more housing construction in general—the financial sector must be involved. Bank of America’s support, in partnership with nonprofit financiers like Enterprise, is important in that regard.

Related:

Stronger Together: How These D.C. Stakeholders Are Collaborating on the Housing Crisis

It's Complicated: Banks' Messy Relationship With Community Development

Who’s Behind Partnership for HOPE SF and What’s It Doing for Affordable Housing?

Joined at the Hip: Community Development Finance and Big Banks

Behind That Major Give for Youth Employment by Bank of America