Corporate Funders Flock to This Community Foundation's Housing Investment Fund

/Lightspring/shutterstock

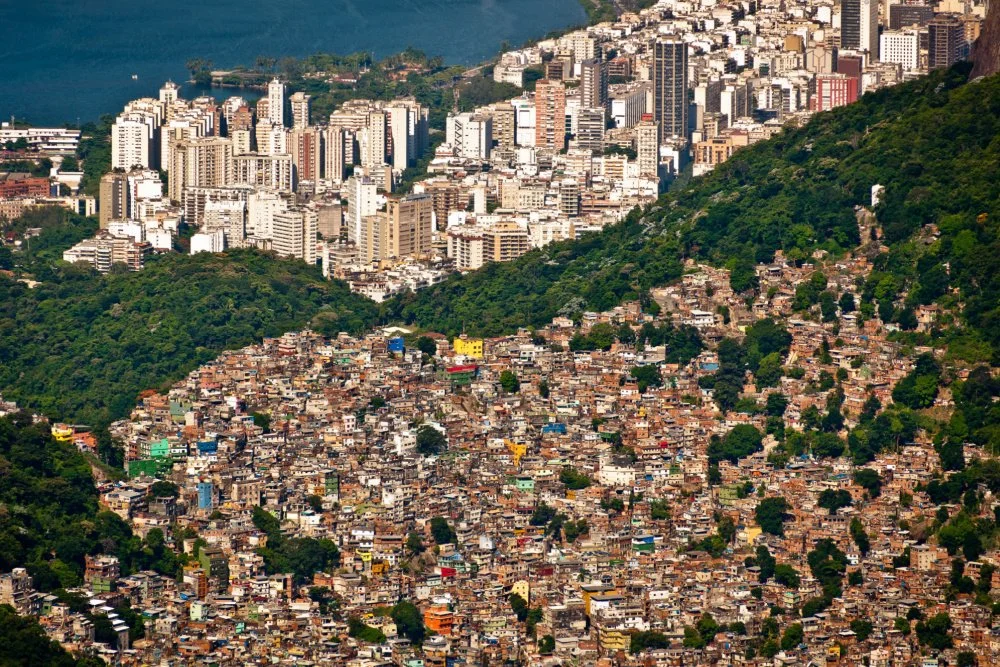

The housing crisis is a vast and diffuse problem, placing intense stress on low-income households as well as many in the urban middle class. But it’s a tough area for philanthropy to move the needle, given the daunting scale of housing challenges relative to what funders can achieve with grantmaking dollars.

To mobilize new resources to build affordable units, more foundations are turning to impact investing—seeing potential here for both social and financial returns in ways that align their endowments and values. The best of these efforts, though, go beyond putting a foundation’s own capital to work and aim to catalyze larger investment pools—on a scale that can really make a difference.

Charlotte, North Carolina, is one place where interesting new work is underway. While the city rarely comes up on the list of top affordability trouble spots, it faces a deficit of more than 30,000 units of affordable housing, and came in at a dismal last place for upward mobility among 50 American cities in a 2013 study by poverty scholar Raj Chetty’s Equality of Opportunity Project.

That revelation spurred Charlotte’s civic and corporate leaders to form a task force on inequality, with housing on the agenda. The effort grew into Leading on Opportunity, a regional anti-poverty initiative with backing from the Knight Foundation, the John M. Belk Endowment, the Z. Smith Reynolds Foundation, and the Foundation for the Carolinas (FFTC).

It might not be common knowledge, but Charlotte ranks second place to New York City itself as the nation’s second-largest banking center. Despite that fact, few banks have gotten behind Leading on Opportunity besides Bank of America—one of the nationwide “Big Four” and the largest financial firm headquartered in Charlotte. But to its credit, the city’s banking sector does seem keen to support an affordable housing impact investment fund housed at FFTC, the region’s star community foundation.

Related:

The Charlotte Housing Opportunity Investment Fund got its start last year with a $5 million program-related investment from FFTC. The community foundation is on the vanguard of a nationwide boom in regional philanthropy, boasting an impressive recent track record and assets in the billions. Its goal for the housing fund is to draw on private support to match money from a $50 million housing bond measure that Charlotte voters passed easily last year.

FFTC’s fund will operate alongside money in the housing trust fund to grow Charlotte’s stock of affordable housing, with management support from the Local Initiatives Support Corporation (LISC). So far, lots of finance companies have thrown their hats in the ring. Total support adds up to $44 million and counting. Early supporters included Bank of America, Ally Financial, and Barings. Wells Fargo also got on board with a commitment of $5 million in the summer of 2018, part of a $20 million pledge to finance affordable housing in Charlotte. As it turns out, that was one precursor to the bank’s recent announcement that it’ll commit a full $1 billion to address the housing crisis nationwide.

Additional supporters include BB&T, which came in with $5 million earlier this year, and SunTrust and the SunTrust Foundation with $5 million. This month, Fifth Third Bank provided another $3 million. Support for the fund in most of these cases came in tandem with other affordable housing commitments adding up to another $104 million.

Outside of finance, backers include Crescent Communities and the owners of Brooks Sandwich House—both donated land—as well as Atrium Health, whose CEO Eugene A. Woods remarked in a press release that “growing evidence continues to indicate that a person’s zip code is as important as their genetic code.” Health grantmakers, as we’ve seen, have become important local housing funders, and that includes a growing crop of health conversion foundations. Woods’ comment reflects the upstream approach popular among health funders these days, a strategy where housing can figure strongly.

According to FFTC, Charlotte’s private and public sectors have committed $223 million between them for affordable housing since May of 2018—not bad for a single year. The fact that a community foundation presides over a decent chunk of that is a testament to such funders’ growing interest in impact investing. Take the San Francisco Foundation, which put forward $50 million in impact investments around housing and equity this spring. Or the Cleveland Foundation’s expansion of its impact investment portfolio to $150 million by 2022. Or Benefit Chicago, a $100 million push to expand local nonprofit impact investments spearheaded by the Chicago Community Trust. The list goes on.

While it’s outside the purview of the FFTC fund, an additional step for some of these funders would be to follow the lead of the Partnership for the Bay’s Future and back policy advocacy to reduce barriers to affordable housing. That effort, located in the Bay Area and backed by the Chan Zuckerberg Initiative, the Silicon Valley Community Foundation, the Hewlett Foundation, Facebook, Kaiser Permanente and others, is one hopeful example of a region’s power players coming together to get at the roots of the housing shortage.

Until more housing funders get behind work to change the rules that govern housing development and finance, impact investments may help, but they’ll only go so far.

Related: