Filling Critical Gaps, a Foundation Looks to Realize the Promise of Opportunity Zones

/Christian Mueller/shutterstock

The Kresge Foundation works to create pathways to opportunities for low-income Americans, especially in urban areas, and it has a long track record of embracing new strategies, including impact investing, to give people a chance to join the financial mainstream. So when legislation within the 2017 Tax Cuts and Jobs Act showed the potential to help distressed communities make gains, Kresge got out in front of it.

That law is the Opportunity Act, which was designed to catalyze prosperity in places that have been bypassed by recent economic growth. The most important new program to address urban revitalization in decades, it provides private investors with significant tax incentives on unrealized capital gains in return for long-term investments in Opportunity Zones (OZs). Within just two years, the IRS—under the auspices of the U.S. Treasury—has certified nearly 9,000 zones in low-income, high poverty census tracts in all 50 states, putting them in the path of up to $6 trillion in capital.

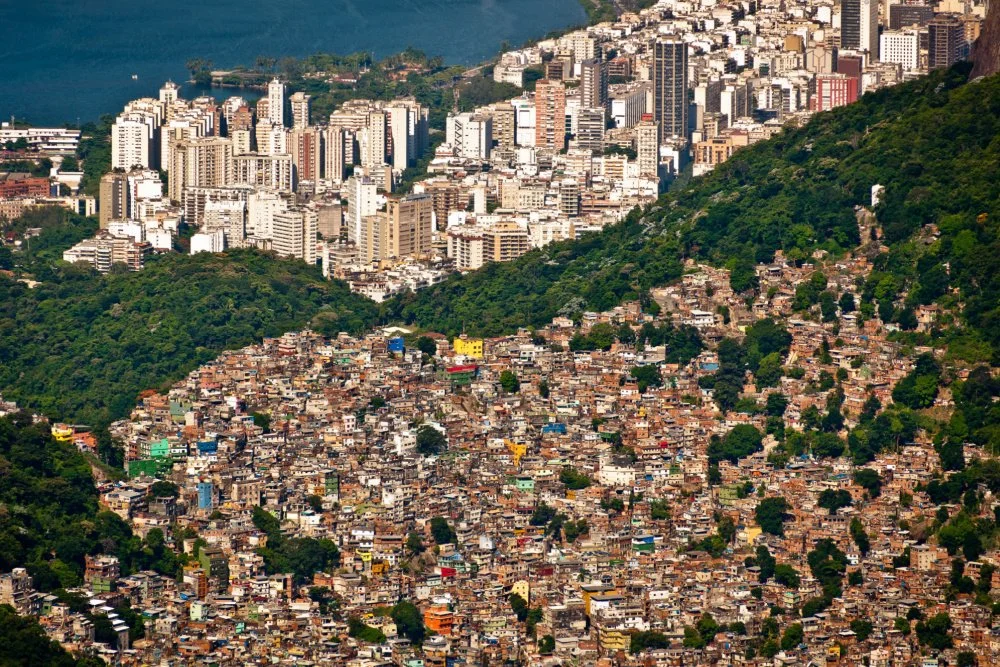

That’s the promise. The catch is that the act came with few rules and resources to ensure that it works as intended. There are no set incentives for investing in, say, affordable housing over a luxury high-rise—raising the risk of gentrification. Transparency is nonexistent. Investors have only the IRS to report to, leaving cities in the dark. When the law was passed, it delegated broad authority to the U.S. Treasury to write rules to prevent abuses and ensure it achieves its stated goals—regulations that are still being developed. Overall, though, the law’s free-market approach means distressed communities have to organize and market themselves to attract any investments at all.

Those factors create a vacuum in public policy, and a real role for philanthropy that Kresge’s stepped in to fill, along with Rockefeller and a handful of other private funders, as we’ve reported.

Filling in the Blanks

While it was still early days, Kresge set out to get the lay of the land on the new marketplace. It funded an Opportunity Zones Incubator at Calvert Impact Capital to provide technical assistance for social impact organizations that were exploring the idea of taking Qualified Opportunity Funds (QOF) to market. And it partnered with Rockefeller to release a call for letters of inquiry from potential OZ fund managers across the U.S. Among their aims were to ensure positive outcomes for low-income communities, find projects that aligned with institutional missions, and gauge the level of interest in partnering with philanthropy.

The foundations expected to receive a few dozen responses. Instead, they received 140. Of those, a dozen managers were invited to participate in the incubator or begin the due diligence process for impact investments.

Kresge was also quick to recognize the lack of sufficient guardrails to ensure responsible investment strategies. Rather than waiting for the IRS to start issuing guidelines, it got at the problem directly, and began working on measures to ensure that action follows intent. Kresge Social Investment Officer Aaron Seybert says they saw their work and the government’s as “apples and oranges.”

By the time Opportunity Zones became effective in July of 2018, the foundation had already drawn up “reasonable” financial and social covenants that prevent displacement, and prioritize the development of affordable housing units. The measures also set requirements on the net-positive creation of living-wage jobs, and prohibit “non-productive” investments in things like self-storage facilities. Upon adoption, fund managers would also be obligated to form community advisory boards, similar to the New Markets tax program’s, to ensure the involvement of people who work in the service of low-income communities.

Then it was decision time. Kresge’s board had already approved a $350 million pool of social investment funding in 2015 for deployment by 2020, and authorized up to $25 million in guarantee capacity. In March, Kresge committed $22 million of that to backing two established fund managers—Boston-based Arctaris and Ft. Lauderdale-based Community Capital Management (CCM)—to anchor their Opportunity Zone Funds. Together, the fund managers are expecting to raise and deploy more than $800 million in zones nationally.

The firms met several criteria. They had experience working with likely OZ investors—families and institutions with significant capital gains. They spoke the language of social impact. And they were the right size to make Kresge’s backing meaningful.

The transaction was a trade-off. The foundation’s guarantees provided the funds with risk mitigation and first-loss protection, and a “name recognition shield” to attract investors. In return, Arctaris and CCM fund managers voluntarily adopted Kresge’s covenants, creating a level of “transparency, accountability and disclosure” that was new to the market.

Principles for Social Impact

Aaron Seybert says the covenants were meant to complement the reporting framework developed by the Beeck Center for Social Impact + Innovation at Georgetown and the U.S. Impact Investing Alliance, and made them even more critical. That framework established several guiding principles, from community engagement and transparency to measurement.

Seybert sees two of them, measurement and transparency, as the real sticking points. He likens the situation to mortgage interest deductions, which were initially created to spur low-income home ownership—but later fell victim to redlining. Those taking deductions are only required to disclose them on tax returns. That means data is only available in the aggregate, making it virtually impossible to track against transactions, or to conduct comparable analyses.

Seybert maintains a healthy skepticism about the act’s success in the long term without a legislative fix. Meanwhile, Kresge remains willing to leverage its name and capital to represent underserved communities across the U.S. that now include thousands of new Opportunity Zones. “We need to be vigilant,” Aaron says, “to put our reputation on the line for people who do not have power.”