Local Efforts to Scale up Impact Investing in Affordable Housing Are Gaining Steam

/Boom times in Seattle have fueled a housing crisis. oksana.perkins/shutterstock

Amid the skyrocketing wealth inequality of a new Gilded Age, many new fortunes have been minted in places outside the traditional big-city haunts of the rich and powerful. That trend has fueled a boom in regional grantmaking as emerging major donors give close to home, providing community foundations and other local entities with new resources. Even in cities like Seattle—home to some of the world’s richest firms and philanthropists—more modest winners in the digital economy abound, and they’re looking for causes to support.

Housing is one issue that’s gaining in popularity among donors and philanthropic organizations alike, and for good reason. In recent years, much of the urban middle class has found itself straining against a housing market that has long been daunting for those with lower incomes. On the local level, the housing crisis manifests in ways that can be very visible and troubling—homelessness being the top example. Meanwhile, a growing body of research has linked stable housing with better outcomes in a range of areas funders care about, like education, community safety and health.

But housing is also prohibitively expensive to create. That makes it a good candidate for impact investing, as funders explore how to make headway in an arena where grantmaking alone won’t achieve much. Community foundations and other local funders are entering that mix, and in places not typically associated with the housing crisis.

Related: Big Giving, Local Focus: Another Case of Exploding Regional Philanthropy, With a Twist

Big Community Foundations Step Up

For instance, the Foundation for the Carolinas is piloting a housing investment fund in Charlotte, North Carolina, that has drawn considerable support from corporations. It will augment resources in Charlotte’s public housing trust fund, which voters elected to expand last year.

In a move that parallels Charlotte, Columbus, Ohio, is also the scene of a new housing initiative that draws on public, private and philanthropic support. Like Charlotte, Columbus doesn’t spring to mind as a housing crisis hotspot. But as Columbus Mayor Andrew J. Ginther pointed out in a news release, there’s still significant need. “More than 54,000 people in central Ohio live at or near poverty, and spend more than half of their income for housing,” he said. Columbus voters approved the city’s first-ever affordable housing bond fund in May, opening up $50 million to address the shortage.

And now, as in Charlotte, the big local community foundation is getting involved. In late June, the Columbus Foundation joined the City of Columbus, Franklin County, and a number of corporate partners to launch a new $100 million Housing Action Fund for the region. The fund will loan money at low cost to developers who commit to affordability requirements, following a plan drafted by the Affordable Housing Alliance of Central Ohio. It’ll be under the management of Columbus and Franklin County’s public affordable housing trust.

The Columbus Foundation got things rolling with a $5 million investment in the Housing Action Fund, adding to $11.5 million the community foundation has dedicated to affordable housing over the past four years. As in Charlotte, financial firms dominate the list of corporate investors. They include Fifth Third Bank, Heartland Bank, Huntington National Bank, Park National Bank, and PNC Financial Services. Nationwide, L Brands and the Columbia Gas/NiSource Charitable Foundation have also signed on. The city estimates that the fund will finance the creation of 2,150 housing units. That’s a significant fraction—though a fraction nonetheless—of the additional 6,000 units a year the city says it needs to meet demand.

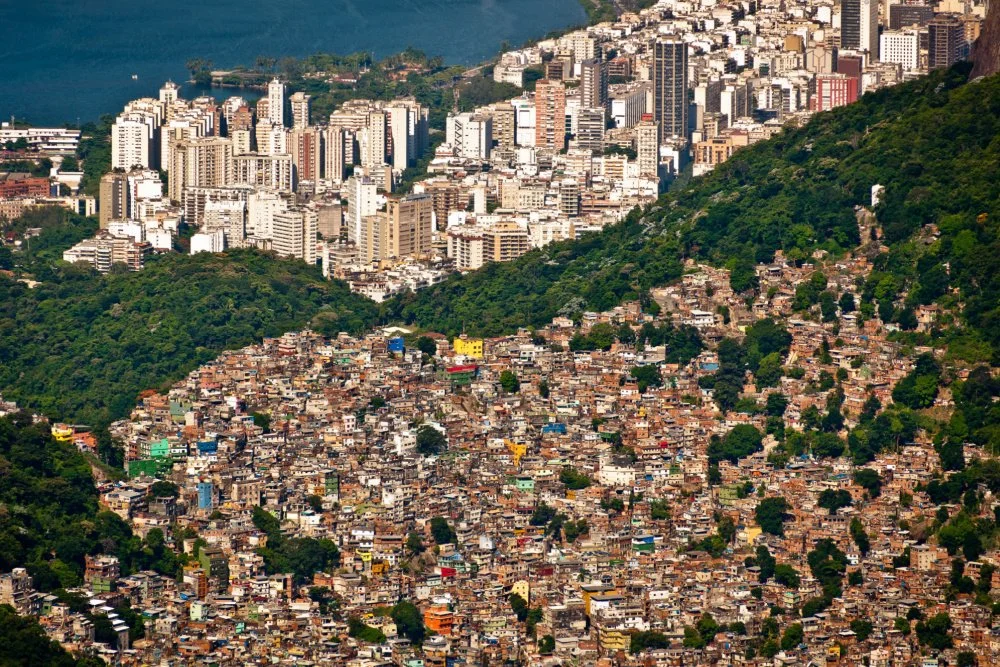

Of course, Columbus’ level of need is modest next to the gnawing deficit of affordable homes in bigger cities—Los Angeles County needs over 500,000 units. But it does underscore the nation-spanning nature of the housing crisis, even in metros where prices are relatively low. Where impact investing is concerned, commitments in the tens and even hundreds of millions may make a dent, but greater scale is necessary for any kind of lasting impact.

The hopeful thing about ramped-up investing in places like Columbus and Charlotte is that it’ll set the stage for more action from the local upper class. Keep in mind that both the Columbus Foundation and the Foundation for the Carolinas have assets exceeding $2 billion. That’s a lot of local money.

Related: Corporate Funders Flock to This Community Foundation's Housing Investment Fund

Crowdfunding Affordable Housing

Of course, when it comes to local money, few cities have more going for them than Seattle. Its metro area is the home of Amazon and Microsoft, and plays host to the monumental Bezos and Gates fortunes, not to mention the huge fortunes of Steve and Connie Ballmer and the late Paul Allen’s estate. As longtime Seattleites often gripe, though, the plentiful new money that mega-corporations and the city’s many smaller tech firms brought into the area have inflated housing prices and fueled inequality.

But the presence of so much local wealth also grants Seattle a potentially untapped source of funding to tackle issues like housing. That’s why it’s interesting to see the region’s innovative energies applied to housing finance through a new investment approach that marries impact investing with crowdfunding.

It’s called the Building Opportunity Fund, and it’s a joint project of Bellwether Housing, one of the area’s leading housing nonprofits, and Tech 4 Housing, a housing advocacy group founded by Seattle tech workers. Following a swanky kickoff at downtown Seattle’s Amazon Spheres, the goal is to crowdfund $4.5 million in impact investments by September to construct 750 affordable units in Seattle and nearby Tukwila. Crowdfunding platform Wefunder is hosting the campaign here.

The Building Opportunity Fund marks one of the very first attempts to crowdfund money for affordable housing. The idea originated with Tech 4 Housing, which approached Bellwether after the Security and Exchange Commission relaxed rules that previously prevented non-accredited investors from investing through crowdfunding. According to Bellwether Housing CEO Susan Boyd, this isn’t just about the money, which comprises only a small portion of what’s needed to build 750 units. The greater goal is to expand community engagement with the idea of a more affordable Seattle. At the time of writing, Bellwether’s campaign has raised $695,000 from eight accredited investors and $64,700 from 24 non-accredited ones.

Regional power players have also been making moves on affordable housing in Seattle. Another nonprofit housing operator, Plymouth Housing, recently raised nearly $50 million for a batch of five new buildings, including donations of $5 million apiece from Microsoft, Amazon and Steve and Connie Ballmer. Microsoft’s contribution is the first piece of a $500 million regional commitment it made early this year to fund affordable housing and combat homelessness. Amazon also wants to motivate its employees to give. Through September, it’s matching up to $5 million in donations to a list of housing and homelessness nonprofits, of which Bellwether is one.

New efforts like the Building Opportunity Fund show the rising sense of urgency that now surrounds the issue of housing affordability—a squeeze long called a “crisis,” but only recently treated as such. And just like in Columbus and Charlotte, where regional firms are joining forces with community funders and local government on housing, impact investing is seen as a key way to get new units built in expensive cities like Seattle and San Francisco. The question is whether it’s possible to marshal enough money this way to move the needle.

Related: Advocacy and More: Philanthropy’s Role in Two Big New Initiatives to Tackle the Housing Crisis